Before you hit “checkout” on your cart, stop and think twice. If you’re still shopping in 2025 without using a cash back site, you’re leaving hundreds of dollars on the table.

Black Friday is already packed with massive deals — the best time of the year to shop — but stacking cash back on top literally makes a world of difference. These sites can turn your Black Friday haul 20–40% cheaper without any extra effort.

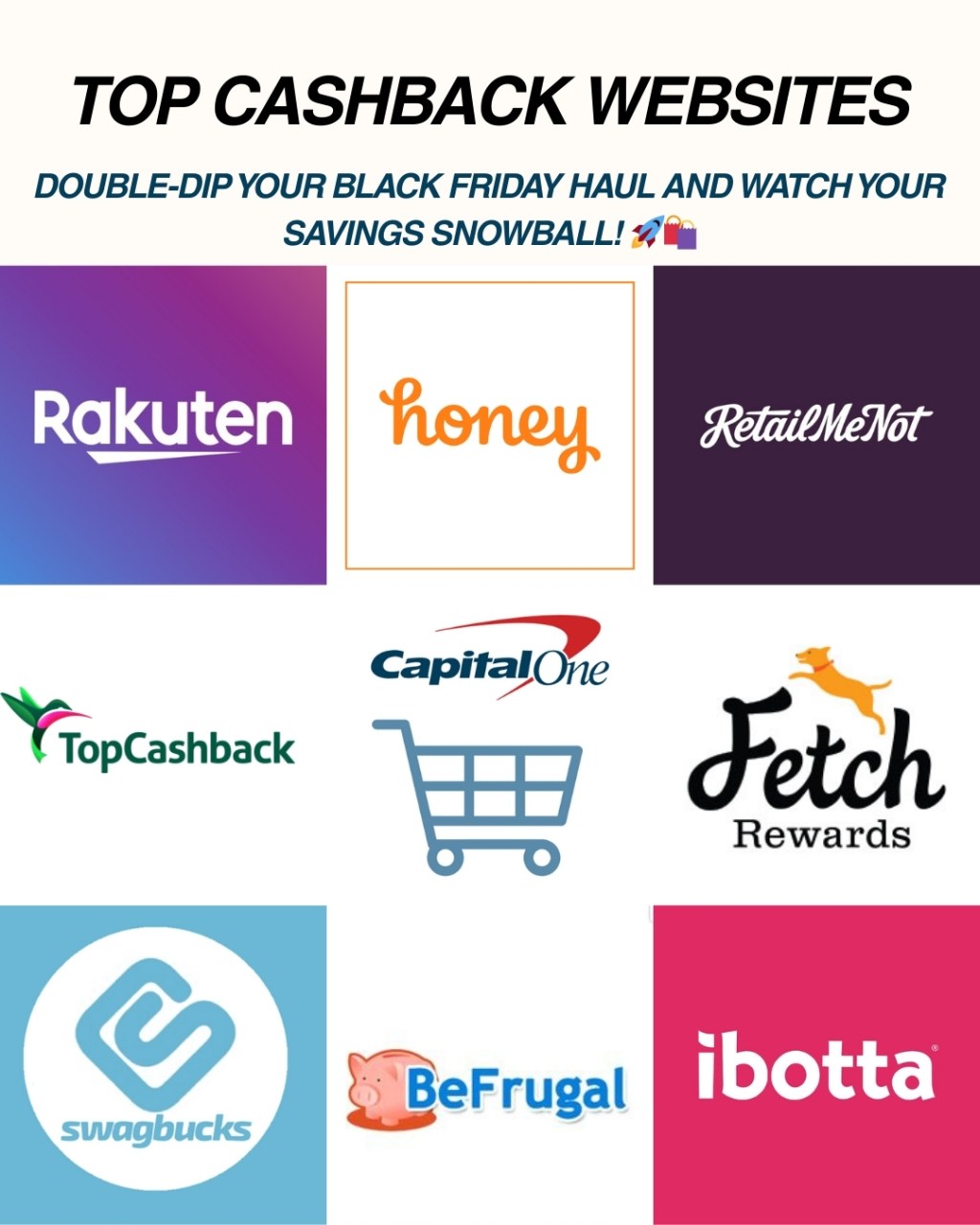

In this article, I’m sharing the 9 best cash back sites and apps that deliver the highest real savings in 2025. Most pay you through PayPal, Venmo, direct deposit, or gift cards once you reach a tiny minimum (usually just $5–$20). Here are the top 9, ranked by reliability, payout speed, and how much extra cash you’ll actually pocket. (Pro Tip: compare cash back rates on different websites before you make the purchase.)

These websites focus on “cash” back. If extra rewards are your bread and butter, stay tuned for the next article on the top shopping portals/rewards programs in 2025 that pay you in extra points/miles instead of straight cash back.

1. Rakuten (the undisputed king)

- Partners: 3,500+ stores (Macy’s, Walmart, Nike, Apple, etc.)

- Typical cash back: 1–15%, spikes to 20–40% on Black Friday

- How you get paid: Big fat check or PayPal every 3 months (they literally mail you a check if you want)

- Why it’s great: Highest double-cash-back events of the year, foolproof browser extension, and a $40 welcome bonus after your first $40 spent.

2. TopCashback (highest rates, zero catch)

- Partners: 7,000+ stores including Apple, Samsung, Adidas

- Typical cash back: Often 1–3% higher than Rakuten on the same stores

- How you get paid: No minimum for PayPal, ACH, or gift cards – cash out $0.01 if you want

- Why it’s great: Passes 100% of the commission to you (most sites keep a cut), making it the highest-paying portal in the U.S.

3. Capital One Shopping (set-it-and-forget-it)

- Partners: 30,000+ sites including Amazon, Target, Best Buy

- Typical cash back: 1-15% + auto-applies coupons

- How you get paid: Gift cards or statement credits

- Why it’s great: Free browser extension works in the background, finds better prices, and stacks with your credit card rewards.

4. Honey (now part of PayPal)

- Partners: 40,000+ stores

- Typical cash back: Honey Gold points → redeem for gift cards

- How you get paid: Gift cards (Amazon, Walmart, Target, etc.)

- Why it’s great: Automatically tests every coupon code at checkout + quietly earns you Gold points that turn into free money.

5. RetailMeNot

- Partners: 20,000+ stores + huge Black Friday “Cash Back Day” boosts

- Typical cash back: 2–20%

- How you get paid: PayPal or Venmo (usually within 45 days)

- Why it’s great: Massive coupon library + legit cash back that often jumps 10–20% during November events.

6. Ibotta (grocery + online hybrid beast)

- Partners: Walmart, Target, Best Buy, Sam’s Club, hundreds more

- Typical cash back: 1-25% online, plus any-receipt bonuses

- How you get paid: PayPal, Venmo, or gift cards as soon as you hit $20 (often faster with bonuses)

- Why it’s great: Works for online pickup/delivery orders and in-store – perfect for stacking on Black Friday grocery runs.

7. BeFrugal (underrated gem)

- Partners: 5,000+ stores

- Typical cash back: 1–40% + exclusive coupons

- How you get paid: PayPal, Venmo, check, or gift cards ($15 minimum)

- Why it’s great: Frequently beats Rakuten and TopCashback by 1–5% and has a $20 sign-up bonus right now.

8. Swagbucks (the all-in-one earner)

- Partners: 10,000+ stores

- Typical cash back: 1–12% in SB points

- How you get paid: PayPal cash or gift cards (as low as $3)

- Why it’s great: Shop + do quick surveys or watch videos to stack even more – people routinely cash out $50–$200/month.

9. Fetch Rewards (receipt snapping simplicity)

- Partners: Any online or in-store receipt (Walmart, Amazon, Target, etc.)

- Typical cash back: 25-5,000+ points per receipt, plus brand-specific offers

- How you get paid: Gift cards from $3

- Why it’s great: Just snap your Amazon or Walmart receipt and get points even if you forgot to click through a portal – the ultimate safety net.

Pro Move for Black Friday 2025

Use CashbackMonitor.com or the browser extension “Cashback Tracker” before every purchase – it instantly shows which of the 9 sites above is paying the highest rate for that exact store in real time. Stack that with a cash-back credit card and you’re looking at 10–50% off everything.

Start with Rakuten or TopCashback for pure online shopping, add Capital One Shopping extension for autopilot, and throw Ibotta or Fetch on top for receipts. Do that this Black Friday and you’ll literally get paid hundreds just for shopping like normal.

Happy stacking – your wallet will thank you!